turbo tax donation value guide|turbotax donation value calculator : Cebu Business or 1099-NEC income. Stock sales (including crypto investments) Rental property income. Credits, deductions and income reported on other forms or schedules. Accurately track and value items you donate to . WEBThe time has come to pig out on riches in our 5-Reel, 20-Payline Slot. Choose the right gold bricks in the 'Pick X of Y' Bonus Game and the base Jackpot of 150,000 can be .

0 · turbotax tax donations value

1 · turbotax my donations

2 · turbotax goodwill donation estimator

3 · turbotax donation value calculator

4 · turbo tax itemized donation list

5 · turbo tax donation tracker

6 · irs estimated value of donated goods

7 · import itsdeductible into turbotax 2022

webIn Theaters At Home TV Shows. Avinash and Abha's life is turned upside down when there 6-year-old daughter Siya is kidnapped; the kidnappers ask Avinash to kill someone to get Siya back, forcing .

turbo tax donation value guide*******But if the FMV is higher than the amount you paid, you must use the original cost of the item. You can get the FMV of your donation by looking at similar items for sale on eBay, Craigslist, or your local thrift store. When you use ItsDeductible, it will assign a FMV to .

Business or 1099-NEC income. Stock sales (including crypto investments) Rental .

If you receive something in exchange for your donation, like a nice meal or a gift .turbo tax donation value guideTo qualify as a tax deduction, your charitable contribution needs to be given .Business or 1099-NEC income. Stock sales (including crypto investments) Rental property income. Credits, deductions and income reported on other forms or schedules. Accurately track and value items you donate to . TurboTax ItsDeductible helps you track and value your charitable donations for tax deductions. Learn how to use it, .The transitional rule applies for donations with valuation dates from May 1, 2019, through June 1, 2023. See Actuarial tables, later. Future Developments. . A used car guide shows the dealer retail value for this type of car in poor condition is $1,600. However, the guide shows the price for a private party sale of the car is only $750. .ItsDeductible Online walk-through - TurboTax Support Video. TurboTax ItsDeductible is a free program included with your TurboTax account. It lets you enter your charitable donations year-round so you can import them directly into your return at tax time. It's available online and as a mobile app.Fair Market Value Calculator. Use the slider to estimate the fair market value of an item. $1 $200. $50. Price. $10.00 - $20.00. Fair Market Value. Below is a donation value guide of what items generally sell for at Goodwill locations. To determine the fair market value of an item not on this list, use 30% of the item’s original price.

turbotax donation value calculatorIn 2020, you can deduct up to $300 of qualified charitable cash contributions per tax return as an adjustment to adjusted gross income without itemizing your deductions. In 2021, this amount stays at $300 for many filers but increases to $600 for married filing joint tax returns. Itemize deductions. To claim qualified charitable donations that .

Multiply .25 BTC by $16,353.37. The result is $4,088.34. This is the FMV of your donation. Note: If your cryptocurrency donation has an FMV that exceeds $5,000, you must get a qualified appraisal. The qualified appraiser will determine the FMV for you, saving you some work. You can do an internet search to find appraisers qualified to value . To reap tax benefits for making charitable donations, you must itemize your deductions rather than taking the standard deduction. (Except that for 2020 you can deduct up to $300 per .The Salvation Army does not set a valuation on your donation. It's up to you to assign a value to your item. For professional advice, please consult your tax advisor. . 2023 Donation Value Guide. 2 /7 For more detailed information on how to donate your vehicle, give us a call at 1-800-SA-TRUCK (1-800-728-7825) or start a vehicle donation . . Step 2—Estimate the value of your car. Look up the fair market value of your car in a used-car guide such as the Kelley Blue Book. Find the make, model and year for your car and use the listed private-party value for the overall condition of the vehicle. For example, if the body is dented, the air-conditioning doesn't work and it has . If you receive something in exchange for your donation, like a nice meal or a gift card, you can only deduct your contribution to the extent it exceeds the value of what you received. So, if you make a $150 donation to a charity that provides you with a meal valued at $50, your tax deduction is $100. Fortunately, most charitable organizations .Emerald Advance℠ Loan. Refund Advance. Small Business. Small business tax prepFile yourself or with a small business certified tax professional. BookkeepingLet a professional handle your small business’ books. PayrollPayroll services and support to keep you compliant. Business formationForm your business and you could get potential tax savings.

If you live in the US, our current tax code allows you to deduct charitable donations from your taxable income. When you are decluttering 40 bags in 40 days, (and throughout the year as well) donations can add up pretty quickly. But they're annoying to keep track of. I've created this printable donation values guide and a donation value .

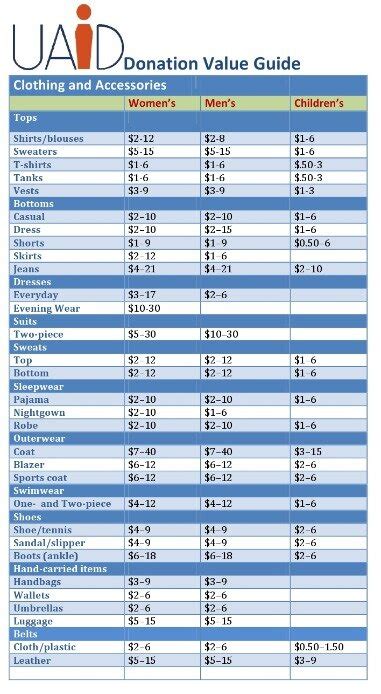

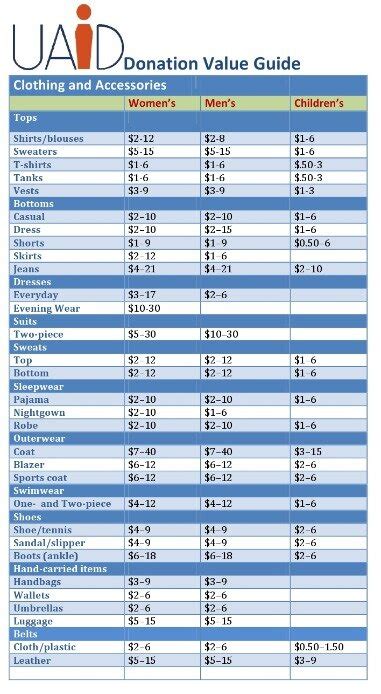

VALUATIO GUI FOR GDIL ORSVALUATION. GUIDE FOR GOODWILL DONORSThe U.S. Internal Revenue Service (IRS) requires donors to value their items to obtain a charitable donatio. s itemized tax deduction. The items donated must be in good used condition or better, and remember, the price ranges. re only estimated values. Be sure to get a .

Salvation Army Donation Value Guide; Goodwill Industries; Tax software. Tax-preparation software, including H&R Block's TaxCut and Intuit's TurboTax, can provide donors with estimated values for clothing and other household goods based on the condition of each item. You describe the item being donated and the program gives an estimate of its .

Salvation Army Donation Value Guide; Goodwill Industries; Tax software. Tax-preparation software, including H&R Block's TaxCut and Intuit's TurboTax, can provide donors with estimated values for clothing and other household goods based on the condition of each item. You describe the item being donated and the program gives an estimate of its .Share: To calculate the charitable donation values of household items, or any items donated to charity you will use the fair market value (FMV) of the property at the time the donation was made. There are many ways to determine the FMV of the item donated. Typically its is the price you could get paid for the item on the open market.

You can get the FMV of your donation by looking at similar items for sale on eBay, Craigslist, or your local thrift store. When you use ItsDeductible, it will assign a FMV to most items that are commonly donated. You must sign in to vote.Accurately track and value items you donate to charities with ItsDeductible™ plus other donations such as cash, mileage, and stocks with our free, easy app.

TurboTax ItsDeductible is free software that values your charitable donations to help you get the biggest deduction possible at tax time. Here's how it works.

Don’t worry about figuring out the accurate value of your donations. TurboTax ItsDeductible will help you accurately value and track your donations year-round, and then you can automatically import your donations into your tax return at tax time.turbo tax donation value guide turbotax donation value calculator If it is over $250, the charity will need to give you written acknowledgement of the donation. It can be a mailed letter or an email, but you need it to prove you made the donation. For property donations, you will need to record the property’s fair market value – that’s what you will deduct.1. Track your donations year-round and watch your estimated tax savings add up. 2. We’ll provide the fair market value for over +1700 items. 3. Easily import your donations into TurboTax at tax time. Start ItsDeductible. When preparing your taxes with TurboTax, you can use ItsDeductible Online to help you value and track your donations. This free program gives guidance on prices for commonly donated items and is designed to . The tax deduction you receive for donations to charities is based on the fair market values of the items donated. Here are some general donation values that may help.

14 de jul. de 2022 · Ninfetas telegram. 14 de julho de 2022 Por. Toda as pessoas querem saber tudo sobre ninfetas telegram, mas pouca gente fala disso.Mas temos que .

turbo tax donation value guide|turbotax donation value calculator